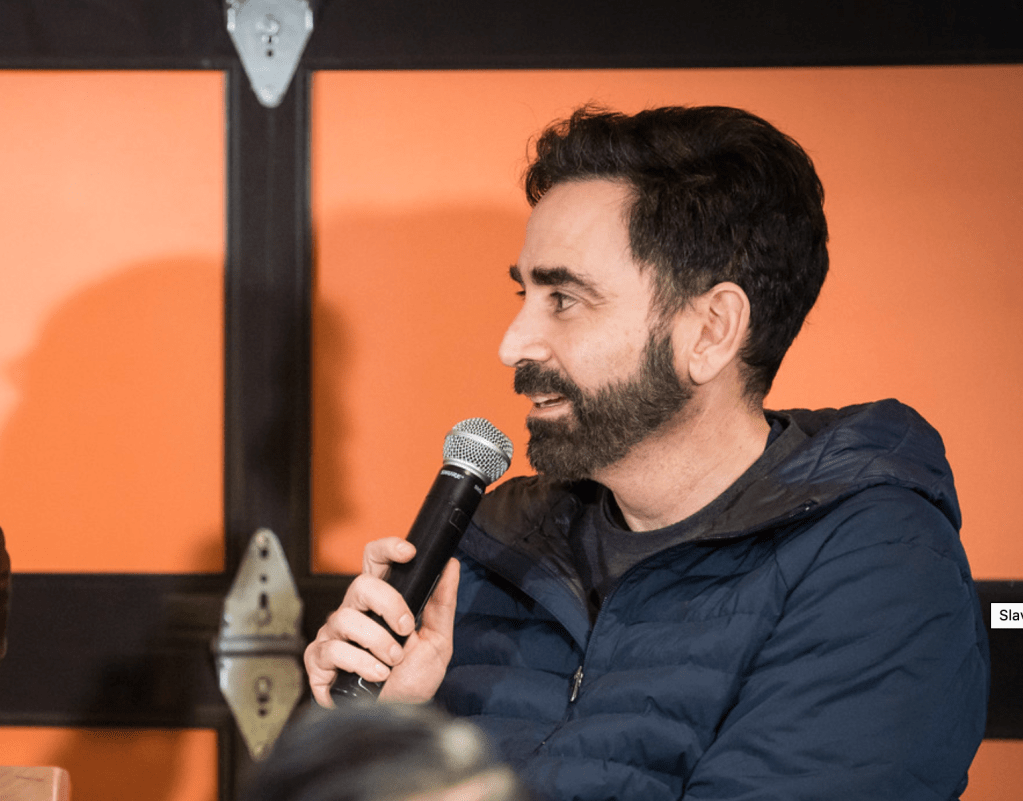

Elad Gil’s Next Bold Move: Investing in AI-Driven Roll-Ups

Elad Gil began his investments in AI before it captured widespread attention. By the time more investors recognized the potential of ChatGPT, Gil had already backed startups like Perplexity, Character.AI, and Harvey. Currently, as the early frontrunners of the AI revolution surface, this prominent “solo” venture capitalist is honing in on an exciting new venture: leveraging AI to transform conventional businesses and scale them through roll-up strategies.

The aim is to pinpoint ripe opportunities to acquire established, labor-intensive companies like law firms and other professional service providers, enhance their efficiency using AI, and then utilize the improved profit margins to acquire additional firms, repeating the cycle. Gil has been implementing this approach for three years.

“It’s incredibly clear,” Gil stated during a recent Zoom conversation. “Generative AI excels in understanding, manipulating, and producing all forms of text, audio, video, and even coding, alongside sales outreach and various back-office functions.”

By effectively converting certain repetitive tasks into software, he indicated, “you can significantly enhance profit margins and create entirely new business models.” The financial benefits are particularly noteworthy when one has full ownership of the business, he noted.

“Owning the asset allows for a quicker transformation compared to merely selling software as a vendor,” he explained. “For instance, if you raise a company’s gross margin from 10% to 40%, that’s a substantial increase. Suddenly, you can acquire other companies at a more competitive price due to increased cash flow per business; this gives you tremendous leverage for roll-ups that others may not be able to seize.”

Thus far, Gil has invested in two companies following this strategy. According to reports from The Information, one is a fledgling venture named Enam Co., which is dedicated to enhancing worker productivity and has garnered a valuation exceeding $300 million from backers, including Andreessen Horowitz and OpenAI’s Startup Fund.

While Gil refrains from discussing the details of private investments, he emphasizes that this methodology signifies a fresh approach. “Years ago, there were technology-enabled roll-ups, but most didn’t genuinely leverage technology,” he remarked. “They often just had a superficial layer of tech to inflate valuations. In the case of AI, there’s potential to fundamentally alter the cost structure of these businesses.”

Whether this endeavor will yield the same level of success as some of his previous investments remains uncertain. Gil has a history of endorsing major brands that have significantly enriched their investors, such as Airbnb and Coinbase, both now publicly traded, as well as the privately held Stripe, whose valuation has recently stabilized around $91.5 billion.

A pivotal challenge with roll-ups lies in assembling the right team, ideally combining a strong technological background with expertise in private equity. “Those skill sets don’t often overlap,” Gil acknowledged. He mentioned having met “maybe two dozen of these teams” but choosing to pass on most, not due to a lack of merit, but because they needed further refinement.

Another distant challenge is the possibility of competitors. Gil’s strong ties within Silicon Valley may lead him to face off against familiar collaborators as more firms, like Khosla Ventures, consider pursuing AI roll-ups.

However, it’s evident that monetary gain isn’t the sole motivator for Gil at this stage. He attributes his ability to foresee trends to genuine passion. “I love technology, progress, and engaging with individuals working on impactful projects, as well as the technology itself,” he shared.

For instance, with the launch of GPT-3, Gil was already experimenting with its predecessor. “When GPT-3 came out, the leap from GPT-2 was so significant that the potential for technology advancement was apparent,” he reflected. “It was clear that if the trend continued, the impact would be transformative.”

His hands-on approach persists today, as he has formed a small team consisting of individuals with extensive engineering experience who actively experiment with various AI front-end technologies. “One team member develops scripts for evaluation, focusing on performance and tooling, which keeps us agile,” he noted.

Thanks to this continuous experimentation, Gil is starting to identify clear leaders in the AI market. “Even six months ago, the more I learned about AI, the more questions I had due to the constantly shifting landscape. But lately, I’ve observed some markets stabilizing,” he said.

In sectors like legal and healthcare, “we’re identifying potential primary champions,” he noted, pointing toward his own portfolio companies as examples, which he referenced in our discussion.

Among his investments is Harvey, which develops advanced language models tailored for law firms and internal legal departments, currently in discussions to secure new funding at a valuation around $5 billion; Abridge, an AI healthcare firm aiming to streamline clinical documentation; and Sierra AI, co-founded by prominent operator Bret Taylor, assisting companies in adopting AI-driven customer service solutions.

Nonetheless, Gil is careful not to declare the competition settled. “I’m not saying it’s all wrapped up; the landscape has shifted from dozens of interesting companies down to perhaps three or four in each sector. The clear path to potential winners is emerging,” he articulated.

In the interim, it’s clear from his dialogue that this period represents more than just another cycle of investment for him. “It’s a fascinating time filled with substantial change, leading to numerous opportunities,” he remarked.

Operating at the crossroads of two transformative shifts—not only betting on AI’s future but also on its capacity to reshape traditional sectors—is simply “exciting,” he concluded.

We will share more insights from our conversation with Gil, which also touched on themes like ethics, oversight, and how organizations can effectively incorporate the technologies crucial to their success, in an upcoming episode of the StrictlyVC Download podcast, airing Tuesday.